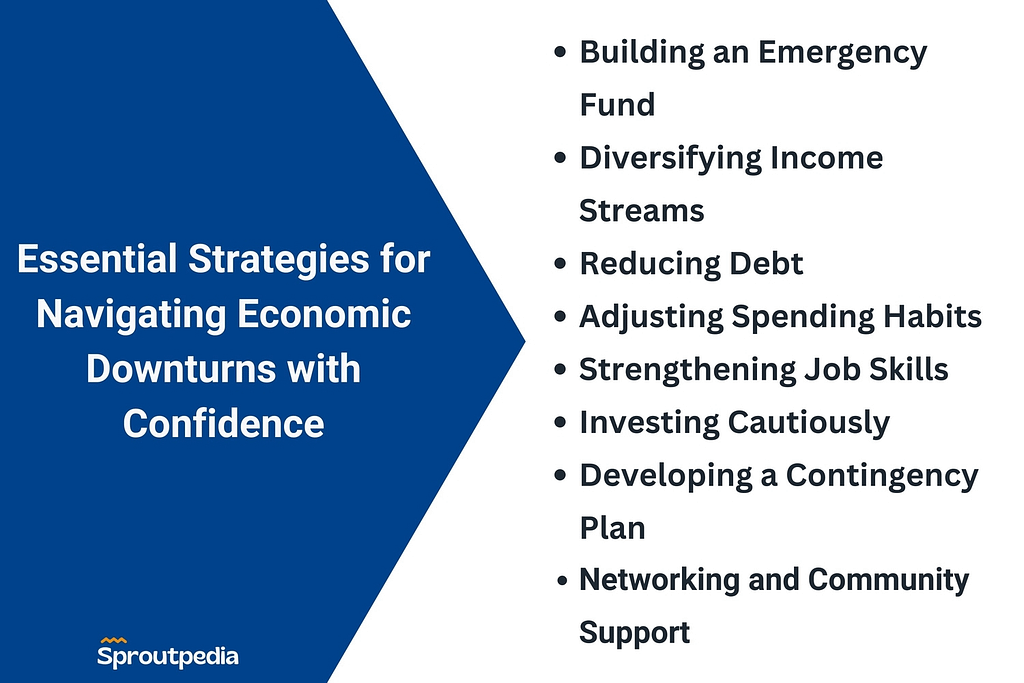

How to Overcome Recession: 8 Steps to Build Confidence During Economic Downturns

In today’s unpredictable economic landscape, It is important to understand how to overcome recession in economy. it’s crucial to be prepared for the unexpected. Recessions can significantly impact personal finances, job stability, and overall well-being. Fortunately, by implementing some key strategies, you can recession-proof your finances and navigate economic downturns confidently. In this article, we’ll discuss ten essential strategies that can help you manage your finances effectively during a recession. So, let’s get started!

Understanding Recession Indicators

The first step in preparing for a recession is recognizing the early signs of an economic downturn. Common economic indicators include

- Gross Domestic Product (GDP). A common rule of thumb for identifying recessions is experiencing two consecutive quarters of negative gross domestic product (GDP) growth.

- Unemployment rate. A common rule, a recession occurs when the three-month moving average of the overall unemployment rate has risen at least half a percentage point above its minimum over the previous 12 months.

- Consumer Spending. Although there isn’t a universally accepted method for identifying an impending recession using consumer spending data, a more significant drop from its peak typically indicates a greater likelihood of entering a recession.

By monitoring these indicators, you can identify potential downturns and take proactive measures to protect your finances.

Educate yourself on how to interpret these indicators and stay updated on economic news through reputable sources. The more informed you are, the better equipped you’ll be to make sound financial decisions before a recession hits.

Building an Emergency Fund and Overcome Recession

An emergency fund is a financial safety net that can provide a cushion during economic uncertainty. This fund should cover at least three to six months’ worth of living expenses, ensuring that you can meet your basic needs in case of job loss or reduced income.

To build an emergency fund, set aside a portion of your income each month, and consider storing it in a high-yield savings account or a money market fund for easy access. Automating your savings can be an effective way to ensure consistent progress toward your emergency fund goal.

Check out our article on How to build an Emergency Fund – 8 Easy Steps

Diversifying Income Streams

Having multiple sources of income is a powerful way to increase your financial security during a recession. By reducing your reliance on a single job or industry, you can better weather income disruptions and maintain your financial stability.

Explore various options for generating additional income, such as side hustles, passive income, and freelance work. Some examples include freelance writing, graphic design, e-commerce, real estate investments, and creating online courses. Evaluate your skills and interests to determine which income-generating opportunities are most suitable for you.

Reducing Debt

High debt levels can exacerbate financial stress during a recession, limiting your flexibility and making it more challenging to navigate through tough times. Prioritize debt repayment before a recession hits to alleviate this burden and create more financial breathing room.

Consider implementing debt repayment strategies such as the debt snowball or debt avalanche methods. The debt snowball method focuses on paying off smaller debts first, while the debt avalanche method prioritizes high-interest debts. Choose the approach that best aligns with your financial goals and motivation.

Adjusting Spending Habits

Reducing discretionary spending and prioritizing essential needs can make it easier to navigate through a recession. Start by reviewing your monthly expenses and identifying areas where you can cut back. This may include dining out, entertainment, subscriptions, or non-essential shopping.

Develop frugal habits and practice mindful spending to ensure that your money is going toward what truly matters. By doing so, you’ll be better prepared to weather financial challenges during an economic downturn.

Strengthening Job Skills

Continuous learning and skill development are vital for maintaining job security during economic downturns. Upskilling or reskilling can increase your employability and resilience in a changing job market, making you a more attractive candidate to potential employers.

Take advantage of online courses, certifications, workshops, or even volunteer opportunities to develop new skills or enhance your existing ones. Additionally, engage in networking and professional development activities to build connections that could be invaluable during times of job instability.

Check out Udemy. It is an online education platform. You can find whatever you want to learn from 213,000 online videos. From coding, project management to a language, whatever that can help you advance your career.

Investing Cautiously

During a recession, it’s crucial to adjust your investment strategies to minimize risk and protect your long-term financial goals. This may involve reassessing your risk tolerance, diversifying your investment portfolio, and focusing on more conservative investments.

Maintain a disciplined approach to investing and avoid making panic-driven decisions that could negatively impact your financial future. Remember that recessions are temporary, and staying the course with a well-balanced investment strategy can help you weather the storm.

Developing a Contingency Plan

Having a contingency plan in place for worst-case scenarios, such as job loss or reduced income, is essential for navigating a recession. Create a detailed plan that outlines alternative income sources, adjusted spending patterns, and any additional support you may need during tough times.

Regularly review and update your contingency plan to ensure it remains relevant and effective as your circumstances change. By doing so, you’ll be better prepared to face any financial challenges that may arise during an economic downturn.

Networking and Community Support

Building strong professional and social networks can provide emotional and practical support during challenging times. Networking can help you stay informed about job opportunities, access valuable resources, and receive advice from others who have successfully navigated through a recession.

Engage in networking activities both online and offline, such as attending industry events, joining relevant social media groups, or participating in community meetups. Remember that giving and receiving support within your community can be instrumental in overcoming financial hardships during a recession.

Staying Informed and Adaptable

Lastly, it’s essential to stay updated on economic trends and be prepared to make necessary adjustments to your financial strategy as needed. Regularly review your financial plan, keeping an open-minded and flexible approach to your personal finance management.

Subscribe to reputable news sources, podcasts, or newsletters to stay informed about financial news and trends. By staying informed and adaptable, you’ll be better equipped to make sound financial decisions and maintain your financial well-being during a recession.

Conclusion

Recessions can be daunting, but with the right strategies in place, you can confidently navigate through economic downturns and safeguard your financial future. By understanding recession indicators, building an emergency fund, diversifying income streams, reducing debt, adjusting spending habits, strengthening job skills, investing cautiously, developing a contingency plan, networking, and staying informed and adaptable, you can successfully recession-proof your finances.

Start implementing these strategies today to ensure you’re well-prepared for any economic challenges that may come your way. Remember, the key to successfully navigating a recession lies in being proactive, informed, and adaptable.